Get Ahead: 10 Practical Financial Goals to Aim for in 2025

As we say goodbye to 2024 and gear up for 2025, it’s the perfect moment to hit pause and reflect on your financial goals. Whatever’s on your radar, having a clear plan isn’t just helpful but a game changer for staying financially secure and achieving those long-term goals.

In this article, we’ll share some practical tips to help set you up in a better financial position in 2025.

Key takeaways:

Some of the short-term financial goals to aim for in 2025 include saving for an emergency fund, reducing takeouts, canceling unused subscriptions, getting an extra source of income, and converting unused gift cards into crypto.

Long-term financial goals include saving for retirement, creating an estate plan, planning for education expenses, creating a diversified portfolio, and getting started with investing.

Short and long-term financial goals for 2025

1. Save for an emergency fund

An emergency fund is a financial safety net designed to cover unexpected expenses such as loss of employment. It is a critical component of sound financial planning, helping to protect you from debt and maintain financial security during challenging times, often when least expected.

Some practical ways of creating an emergency fund include automating savings, opening a dedicated savings account, starting small, and only tapping into the fund when you have a true emergency—don’t see it as a personal piggy bank.

💡Pro-tip: Experts recommend that you need to create an emergency fund that lasts between 3 to 6 months of expenses.

2. Reduce takeout food/food deliveries

In an era where food delivery apps and dining out have become increasingly popular, cooking at home offers a practical and cost-effective alternative. Not only does it help you save money, but it can improve your health and you improve your cooking skills.

Some ways to reduce this expense include uninstalling food delivery apps on your phone, preparing food in batches, repurposing leftovers, and learning how to cook. There are plenty of YouTube videos to guide you through.

💡Pro-tip: Eating out daily can cost up to $2600 annually. The average American household spends up to $3600 per year on takeout.

3. Cancel unused subscriptions

Streaming platforms, fitness apps, software tools, and meal kits can silently drain your budget. Conducting a regular subscription audit helps you identify unnecessary expenses, cut back, and save money. With the average consumer paying $1000 per year on subscriptions, it can become a quick money drainer if left unchecked.

💡Pro-tip: For all subscriptions, you must ask yourself: Do I use this subscription regularly? Does this subscription align with my priorities? Is there a cheaper alternative? Is this an impulse subscription? And could I live without it?

4. Get an extra source of income

Explore freelance opportunities that match your skills, like writing or graphic design, on platforms such as Upwork or Fiverr. Consider gig economy jobs like driving for Uber or delivering food with DoorDash, which offers flexible schedules. You can also declutter your home and sell unused items on eBay, Facebook Marketplace, or through a garage sale.

Other opportunities available for secondary income include affiliate marketing and leveraging your experience to sell an online course.

💡Pro-tip: Don’t try and do everything. Pick one core area and specialize in it.

5. Set aside a portion of your income for your wants

If you dream of a vacation that costs $2,000 and want to make it happen in 10 months, a great plan is to set aside $200 each month in a dedicated travel savings account. This way, you can watch your savings grow specifically for that trip, making it feel more achievable. By consistently saving each month, you’ll be well on your way to enjoying that getaway without any financial stress!

💡Pro-tip: A separate account helps keep your travel fund distinct from your regular savings, making you less tempted to dip into it for other expenses.

6. Save for retirement

Starting early when saving for retirement is one of the most impactful financial decisions you can make. The earlier you begin, the more time your money has to grow through compound interest, where earnings on your investments generate their earnings over time.

Retirement savings tools like IRAs and 401(k)s can amplify these benefits. In the case of Roth IRAs, IRAs (Individual Retirement Accounts) offer tax advantages, such as tax-deductible contributions.

Employer-sponsored 401(k) plans often include matching contributions, further boosting savings. Better still, these accounts provide access to diverse investment options, from mutual funds to bonds, allowing you to build a balanced portfolio.

Related: What’s Bitcoin IRA, and how does it work?

7. Create an estate plan

A solid estate plan, complete with a will, trusts, and life insurance, ensures your assets go exactly where you want them to be. It also helps cut down on taxes and supports the people you care about most when you are no longer there.

Without an estate plan, your assets could be tied up in court, leading to delays and potential legal complications. By planning, you can also ensure that your family is financially protected, particularly in unexpected circumstances.

💡Pro-tip: Create an estate plan when you achieve the age of majority.

8. Invest now rather than later

Think of investing like planting a tree. It was better to plan one twenty years ago; the next best time is now. The sooner you plant, the sooner it grows, providing shade and fruit when needed most. Starting your investment journey today is one of the smartest steps you can take for your long-term financial future.

The power of investing lies in time. The earlier you start, the more opportunities your money has to grow through compound interest—the snowball effect where your returns generate even more returns. Waiting might feel easier, but every year you delay is like missing a growing season for your tree.

9. Plan for educational expenses

Whether for your children or yourself, planning for education expenses is an important long-term financial goal. Consider opening a college savings plan, which offers tax advantages for education savings.

Contributing regularly to this account can help you manage the rising education costs while allowing your investments to grow over time. If you’re considering furthering your education, setting aside funds for courses or certifications can enhance your career prospects and earning potential, making it a worthwhile investment in your future.

10. Diversify your investment portfolio

A well-rounded approach involves spreading your investments across various asset classes, such as stocks, bonds, and real estate, to cushion against market volatility. For instance, allocate some of your funds to large-cap stocks for growth while including some bonds for stability.

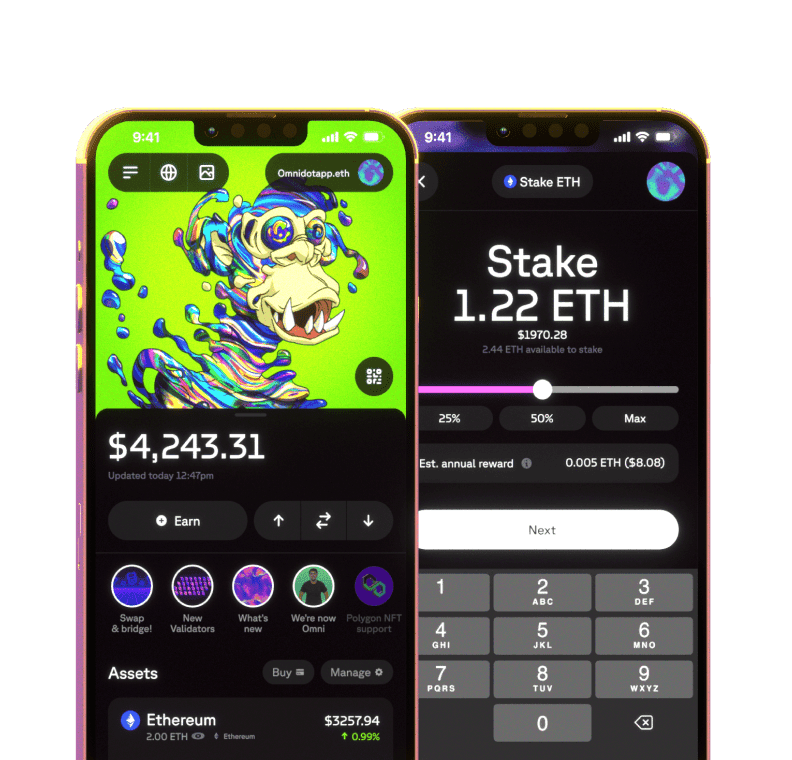

Incorporating a diversified crypto portfolio can also be an exciting option. This means diversifying within the crypto space, investing in a mix of established cryptocurrencies like Bitcoin and Ethereum, and exploring promising altcoins and blockchain projects.

Important Note: Omni.app does not provide investment, tax, or legal advice, and you are solely responsible for determining whether any financial transaction strategy or related transaction is appropriate for you based on your personal investment objectives, economic circumstances, and risk tolerance. Omni.app may provide information that includes but is not limited to blog posts, articles, podcasts, tutorials, and videos. The information contained therein does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the content as such. Omni.app does not recommend that any digital asset should be bought, earned, sold, lent out, or held by you, and will not be held responsible for the decisions you make to buy, sell, trade, lend, or hold digital assets based on the information provided by us.