What is Sushi?

Sushi is an all-in-one DeFi platform offering spot trading, lending, liquidity mining, and much more.

The platform is deployed on 14 different chains, allowing you to access its products on virtually all major networks.

Sushi has been consistently one of the most utilised DeFi projects and ranked in the top ten protocols by fee generation which can be seen here.

Sushi is primarily a decentralized exchange built on Ethereum that utilizes an AMM (automated market maker) system rather than a traditional order book. Instead of matching individual buy and sell orders, users can pool together two assets that are then traded against, with the price determined based on the ratio between the two. Even though it started as a purely decentralized exchange, it has grown into an all-in-one DeFi platform.

Since its inception it has grown to support 14 different chains and ecosystems, making it easy to trade with it on almost all major networks. On top of it, it has evolved its product line to include a decentralized exchange, a decentralized lending market, yield instruments, an auction platform, an AMM framework, and staking derivatives. Sushi operates as a DAO with SUSHI token holders participating in the major decisions through the decentralized governance, Whereas major structural changes are voted on by the community, the day-to-day operations, rebalancing of pools and ratios, business strategy, and overall development are ultimately decided on by the core team.

Sushi has had its fair share of controversies throughout the years. As mentioned, Sushi began as a simple fork of Uniswap. What made it different at the time was the fact that Sushi offered both a governance token (SUSHI) and liquidity mining. Initially it let users stake Uniswap LP tokens on Sushi to earn SUSHI governance tokens which incentivized them to move liquidity from Uniswap to Sushi, leading to a spike in liquidity on Sushi as investors chased the high yields.

In September 2020 Chef Nomi – the creator of Sushi drained the development fund, swapping it for 37,400 ETH, worth some $14 million at the time. However, after a few days of facing pressure from the community, Chef Nomi voluntarily returned the ETH and apologized to the community.

Following those events, the community set up clearer rules for ownership and control of the protocol in order to move forward in a safe and sustainable way. The effective ownership of Sushi got split into Multisig and Operations Multisig addresses.

Since then, Sushi has become one of the most utilized avenues for trading, liquidity mining, and generally interacting with DeFi and regained the trust of users by providing a quality experience and partnering with blue-chip DeFi protocols such as Yearn, AAVE, Pickle Finance, and others.

Many Sushi supporters prefer to not sell their SUSHI and find liquid staking to be a great way to passively earn more SUSHI. Learn more about staking and how you can earn with your SUSHI from liquid staking.

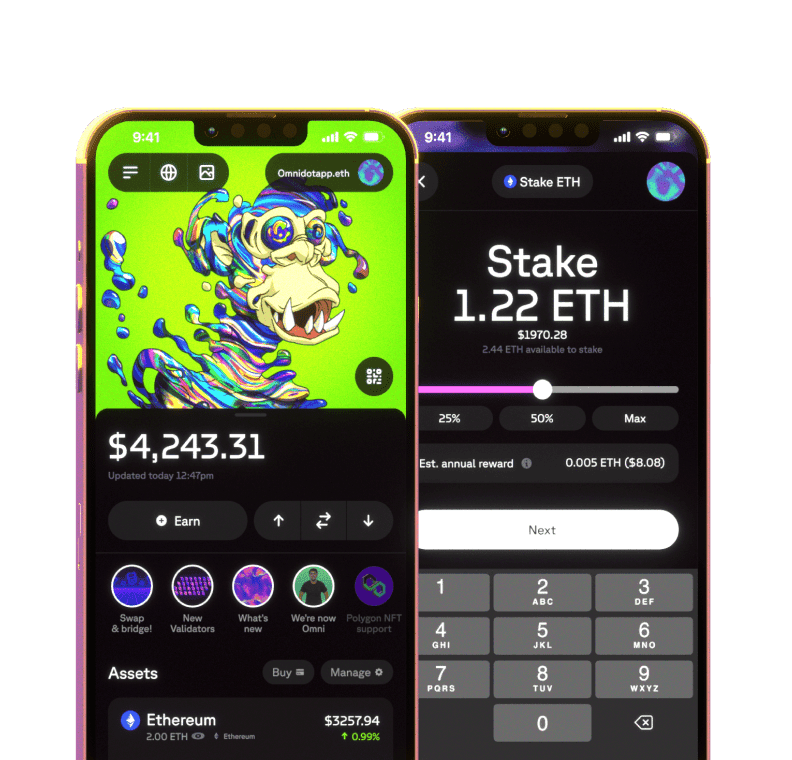

Omni -

Omni -