Risks of staking OSMO

As a result of the openness of the crypto markets, there are more ways than ever before to earn passively. Staking cryptocurrency has arisen as a common strategy to generate investment income as a result of its ease and minimization of risk when contrasted with other strategies. Although staking is a less risky way to generate yield on crypto assets, like all forms of investing, staking is not completely risk-free.

In this analysis, we will break down three main risks to consider when staking your Osmosis Tokens to ensure that you are fully informed before locking up your OSMO.

Market Risks

A risk that often gets overlooked by investors before staking their crypto assets is negative fluctuations in the price action of the staked asset.

The crypto market is continuously evolving as new products and upgrades are implemented and market cycles take hold. As these evolutions take place, they can directly affect the value of your staked assets.

For example, if you are staking your OSMO at a rate of 20% APY but the value of OSMO drops 65% as a result of market conditions, you will still have made a loss despite gains from your APY.

Before locking up your OSMO it is important to not just consider the APY, but holistically analyze the market.

Liquidity Risks

Liquidity, or the ability to have access to tokens that can be used readily while minimizing price volatility, is another important risk to consider before locking up your assets.

For example, if you are looking to stake an altcoin with a micro-cap and want to realize your gains by selling your asset or converting into BTC or a stablecoin, it will be difficult as a result of lower demand, higher volatility, and lower trading volume than larger tokens.

It is important to remember that your assets will also be illiquid during the period of time your OSMO is locked. Once you commit your OSMO tokens to be staked, you will not be able to sell, withdraw or swap them for another asset until your lock is complete. If you would like to unstake in order to regain your liquidity, there is an intermediary waiting period for your token to unlock. The unlock times vary between assets but in the case of OSMO there is a 14-day waiting period from the time you unstake until the time you regain liquidity over your OSMO tokens.

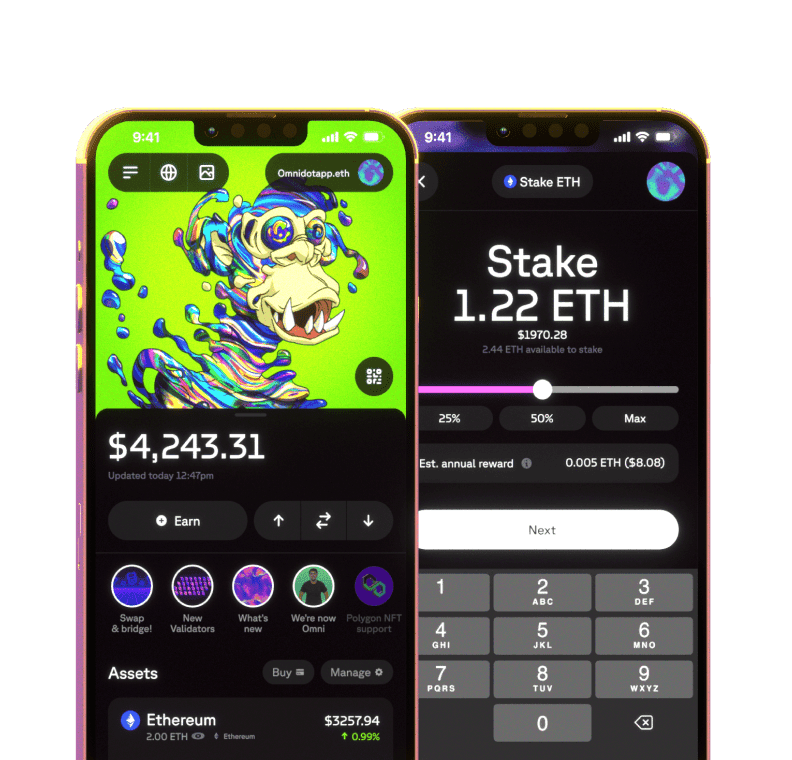

To avoid illiquidity make sure to be mindful of staking locks and stake assets with high trade volumes on a reputable platform like Omni.

Validator Risks

One of the main risks when running a validator node is overcoming the knowledge barrier to obtain the technical abilities to ensure everything is set up correctly. Staking nodes need to be running all the time to obtain maximum returns and disruptions to the staking process minimize this.

There are also penalties that will impact staking returns if a validator node misbehaves. Some of these penalties include:

Slashing - when a portion of the validator’s staked tokens is taken away as a result of harmful behavior. This will usually take the form of a percentage. In some cases, there are different percent penalties based on the severity of the behavior. For example, a slashing penalty for downtime may be a small slap on the wrist (.01% loss), while the penalty for double signing could be more severe (5% loss).

Jailing - validators are usually jailed for either having too much downtime or for double signing blocks. Once a validator is jailed it is no longer considered active until it is unjailed.

When running a validator with Osmosis possible penalties include:

Jailing - this happens as a result of Validators who misbehave. Misbehaving validators are jailed or excluded from the validator set for a period of time.

Slashing - this happens when a validator becomes unavailable or misbehaves. If your validator is jailed it is not uncommon for your voting power to be slashed for downtime.

The entire guidelines for running a validator with Osmosis can be found here

While staking is relatively safe, it is important to stake your tokens with the right validator. Learn more about how to stake OSMO with a reputable validator like Figment.

Omni -

Omni -