Risks of liquid staking SUSHI

As a result of the openness of the crypto markets, there are more ways than ever before to earn passively. Staking cryptocurrency has arisen as a common strategy to generate investment income as a result of its ease and minimization of risks involved in generating yield. Although staking is a less risky way to generate yield on crypto assets, like all forms of investing, staking is not completely risk-free.

Compared to liquid staking AVAX, ETH, SOL, and others, SUSHI staking doesn’t work in the same way. With SUSHI liquid staking, you aren’t securing the network itself, but sharing in the revenues of SushiSwap, making it more similar to liquidity providing. Sushi, like many other DEXs, takes 0.3% fee on each trade, and 0.05% of all revenues are distributed to SUSHI stakers.

There is a number of potential risks when staking SUSHI through Sushibar and we’ll cover them below.

Smart contract risk

There is an inherent risk that your liquid staking service provider could contain a smart contract vulnerability or bug. While Sushi’s code is open-sourced, audited, and covered by an extensive bug bounty program to minimize the risk, be mindful that you are still interacting with a piece of code.

Utilization risk

Rewards you receive from staking SUSHI are based on the utilization of Sushi platform and the generated revenues. If anything that would undermine the popularity and usage of Sushi happens, the staking rewards might plummet and you won’t be earning as much as is projected. At the same time, the value of your underlying might drop.

Market risks

A risk that often gets overlooked by investors before staking their crypto assets is negative fluctuations in the price action of the staked asset. The crypto market is continuously evolving as new products and upgrades are implemented and market cycles take hold. As these evolutions take place, they can directly affect the value of your staked assets.

For example, if you are staking your FTM at a rate of 20% APY but the value of FTM drops 65% as a result of market conditions, you will still have made a loss despite gains from your APY.

Transaction fees

Staking SUSHI requires you to complete a transaction and then one more when you want to unstake. All transactions result in paying gas fees, which can be quite high depending on the utilization of Ethereum. When staking smaller amounts, it might take you a while to recoup the costs of staking. E.g. if you liquid stake 1000$ worth of SUSHI and pay two transactions costing you 15$ each, you’ll lose 3% of your initial value. Meanwhile, the xSUSHI APY is 6% (at the time of writing), meaning you’ll have to liquid stake for more than half a year if nothing changes.

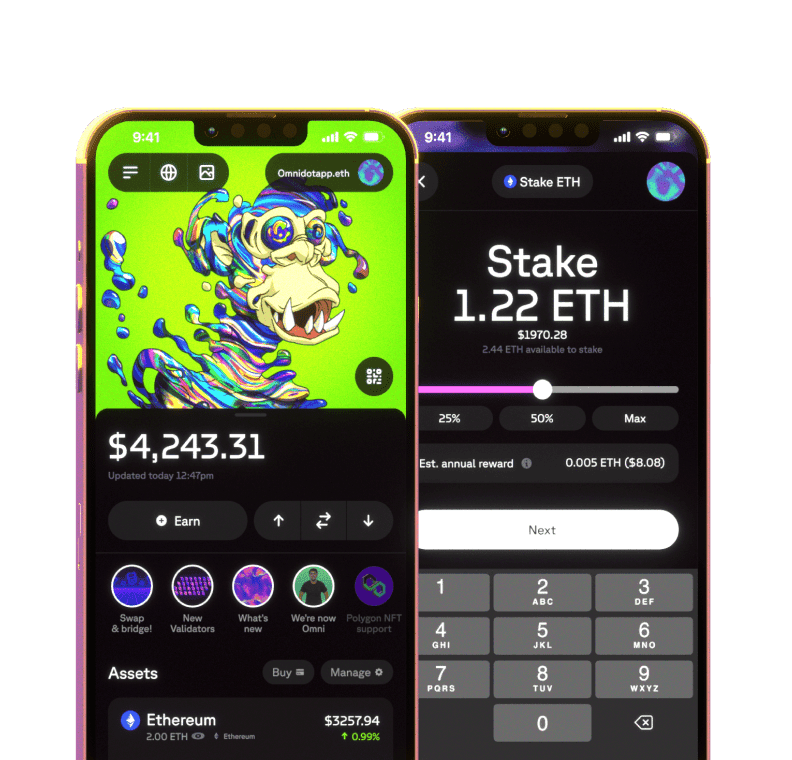

Liquid staking can be a great way to earn a yield on your assets. However, be aware of the risks that are involved. Learn more about how to liquid stake SUSHI through Omni.

Omni -

Omni -