Risks of liquid staking ETH

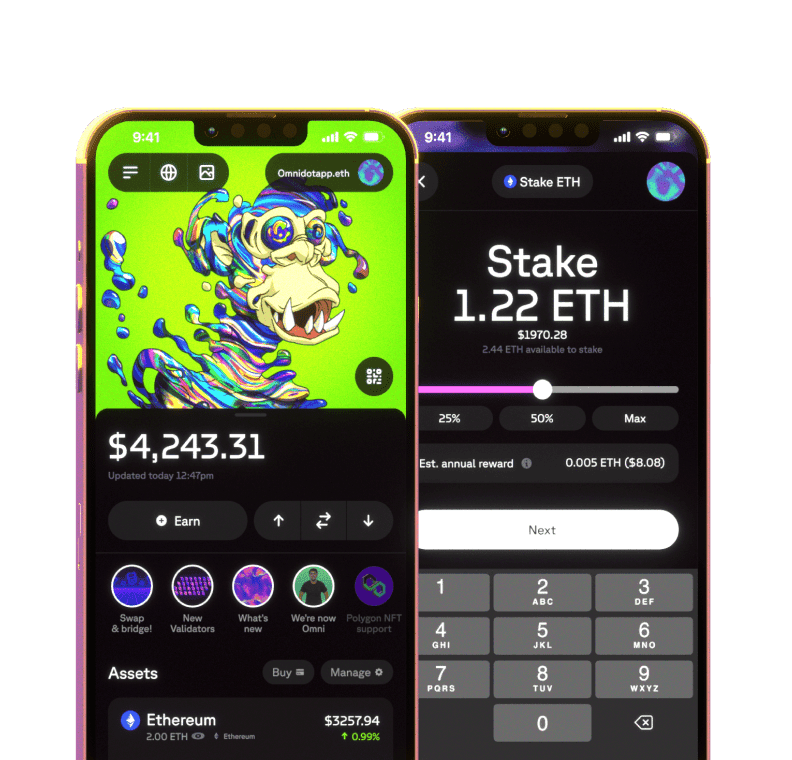

As a result of the openness of the crypto markets, there are more ways than ever before to earn passively. Staking cryptocurrency has arisen as a common strategy to generate investment income as a result of its ease and minimization of risk when contrasted with other strategies. Although staking is a less risky way to generate yield on crypto assets, like all forms of investing, staking is not completely risk-free.

Specifically, there is a number of potential risks when staking ETH using liquid staking protocols. This article will focus primarily on the risks associated with liquid staking with Lido, but they generally apply to ETH liquid staking as well.

Smart contract security

There is an inherent risk that your liquid staking service provider could contain a smart contract vulnerability or bug. For example, Lido is one of the biggest liquid staking services. While Lido’s code is open-sourced, audited, and covered by an extensive bug bounty program to minimize the risk, be mindful that you are entering the staking pool with some risk.

ETH 2.0 - Technical risk

The ETH staking pool is built atop experimental technology under active development, and there is no guarantee that the proof-of-stake Ethereum technology has been developed error-free. Any vulnerabilities inherent to Ethereum brings with it slashing risk, as well as liquid staked ETH fluctuation risk.

ETH 2.0 - Adoption risk

If you are staking with a validator that provides a representation of you ETH — for example, stETH with Lido, the value of your stETH is built around the staking rewards associated with the Ethereum beacon chain. If the PoS Ethereum fails to reach the required levels of adoption, significant fluctuations in the value of ETH and stETH could occur.

DAO key management risk

Ether staked via the Lido DAO is held across multiple accounts backed by a multi-signature threshold scheme to minimize custody risk. If signatories across a certain threshold lose their key shares, get hacked, or go rogue, funds risk becoming locked.

Slashing risk

ETH validators risk staking penalties, with up to 100% of staked funds at risk if validators fail to validate transactions. To minimize this risk, Lido stakes across multiple professional and reputable node operators with heterogeneous setups, with additional mitigation in the form of cover that is paid from Lido fees.

stETH price risk

Users risk an exchange price of stETH, which may be lower than its inherent value due to withdrawal restrictions on Lido, making arbitrage and risk-free market-making impossible.

The Lido DAO is driven to mitigate the above risks and eliminate them entirely to the extent possible. Despite this, they may still exist.

While liquid staking is relatively safe, it is important to stake your tokens with the right validator. Learn more about how to stake ETH with a reputable validator like Lido.

Omni -

Omni -