Editorial Notes (vol. 22) – Get your stETH to work

The beauty of liquid staking is that it unlocks the liquidity of your position. Instead of being locked in a staking position as with regular staking, liquid staking allows you to use yield-bearing tokens which represent your staked position just as you would any other token. Be it by providing liquidity, using it as collateral and borrowing, utilizing different farms, or a combination of them all.

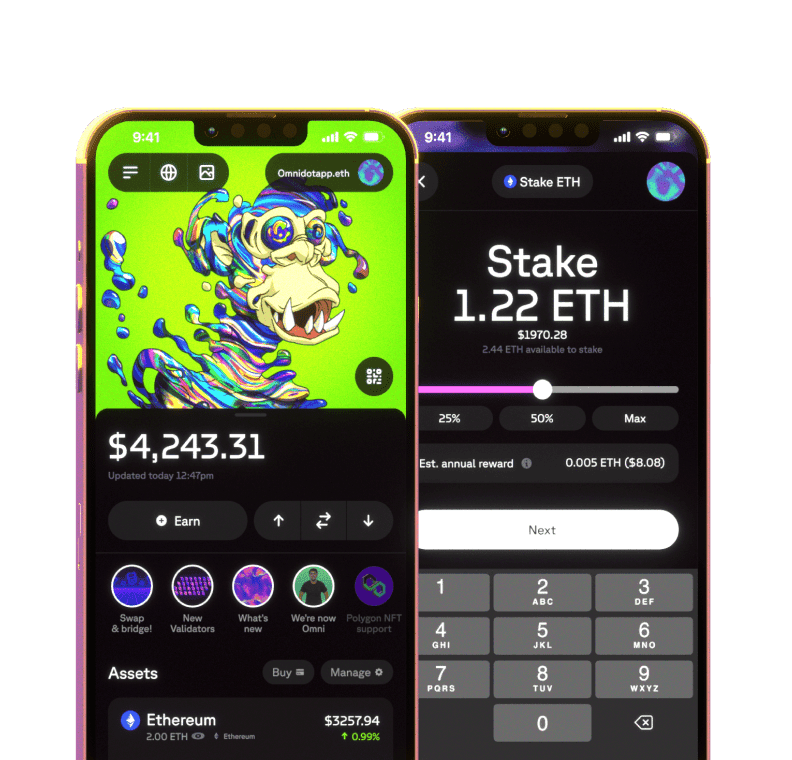

With Omni, you can easily liquid stake ETH through our Lido integration and then use the stETH to boost your base yield. There are multiple projects building products you can take advantage of and in this week's Explore Screen feature we'll be exploring just that.

Currently, the opportunities reside on the Mainnet, but we are expecting to see more interesting options on Arbitrum and Optimism in the future, as bridging of wstETH is enabled and projects start building more products around stETH.

Get your stETH to work

With the Merge behind us, we’ve gathered some of the best projects to utilize with your yield-bearing ETH tokens. Earning 4.9% APY from staking ETH is not bad at all, however, there are so many ways to boost that yield and generate extra returns.

Let's jump right into the projects themselves!

Earn on your deposits and borrow with AAVE.

Aave is a decentralized non-custodial liquidity market protocol where users can participate as depositors or borrowers. Depositors provide liquidity to the market to earn a passive income, while borrowers are able to borrow in an overcollateralized (perpetually) or undercollateralized (one-block liquidity) fashion.

AAVE V2 is deployed on Ethereum and there you can easily supply your stETH. The APY is low, however, you can borrow against it and use the borrowed funds in other DeFi dApps to generate extra yield.

Utilize hundreds of Curve liquidity pools, and trade with high liquidity, low slippage, and low transaction fees.

Curve is an exchange liquidity pool designed for extremely efficient stablecoin trading and trading of pairs that are highly correlated. It also enables users to engage in low risk, supplemental fee income for liquidity providers, without opportunity cost.

On Curve, you can deposit stETH in their stETH-ETH pool to earn the fees by providing liquidity. In return, you’ll receive the Curve LP tokens, representing your stake in the pool, which can be further used in other DeFi protocols.

Maximize Convex APYs and earn yield in the best DeFi tokens on Concentrator.

Concentrator is a yield enhancer that boosts yields on Convex vaults. Users deposit Curve LP tokens, which are automatically staked in Convex vaults. Rewards are periodically harvested, swapped to cvxCRV, and deposited in the Concentrator vault. The Concentrator vault stakes deposited cvxCRV on Convex, then auto-compounds the resulting rewards back to more cvxCRV.

At the moment, Concentrator is running the IFO (initial farm offering) whereby users who deposit their assets in its vaults receive CTR – Concentrator’s governance token instead of the regular rewards. One of the yield-generating farms is the stETH pool which you can utilize by either zapping in or depositing the correct Curve LP tokens.

Earn a yield, multiply your exposure, or borrow against your crypto with oasis.app.

Oasis allows you to easily deploy capital to Maker protocol and the rest of DeFi. It offers multiple products – Earn, Borrow, and Multiply. Through them, you can mint DAI using your deposits as collateral, multiply your exposure to an asset by utilizing borrowed Dai to buy more collateral, or earn Uniswap V3 trading fees with DAI.

Use Harvest Finance to automatically farm tokens.

Harvest Finance is a Yield Aggregator that aggregates and automates the process of yield farming for its users. It collects tokens from many users and stakes them en-masse, saving them network fees (gas) and improving annual returns through auto compounding mechanisms.

Yearn uses automated strategies to help maximize yield for users.

Yearn is a DeFi vault and yield aggregator that helps users generate the highest yield farming profits by providing easy access to complex strategies. When you deposit assets into Yearn products, you gain access to the best automated strategies for swapping funds between DeFi protocols.

Yearn further optimizes token lending by algorithmically finding the most profitable lending services and the highest yields, making farming accessible to the masses and giving new users access to advanced strategies. Essentially, Yearn vaults (which Omni has natively integrated) can best be described as actively managed mutual funds where the investment strategies are performed by Yearn's self-executing code and one of the available vaults is offering the stETH strategy.

Choose your pool, deposit your crypto, and let Vesper Finance put DeFi to work for you.

Vesper is a DeFi ecosystem and growth engine for crypto assets, providing a suite of yield-generating products focused on ease of use, optimization, and longevity. Vesper enables users to passively grow their crypto holdings and maintain their own strategies.

One of the strategies Vesper offers is the Grow Aggressive stETH Pool with which you can easily deposit your stETH to earn VSP rewards and base stETH yield.

Idle Finance offers different strategies for multiple tokens and allows you to choose the best one depending on your risk profile.

Idle finance provides two different strategies depending on your risk tolerance — Senior and Junior Tranches. When you go to their site, you can decide which one works better for you. Senior tranche receives lower rewards but has built-in protection in case of the loss of funds. Junior tranche achieves a greater and leveraged yield by dragging more risk, and in turn, is compensated by the Senior tranche.

FAQ

What is the risk of loan liquidation?

Due to volatility in crypto your collateral might quickly change in value. If the value of your collateral falls below the borrowed value or gets extremely close to it, you might lose your collateral due to the liquidation of your position.

What are APY and APR?

They are measurements for expected annual yields or returns. Annual percentage rate (APR) and annual percentage yield (APY). APR does not account for compounding — reinvesting gains to generate larger returns — but APY does.

Omni -

Omni -